What Does Paul B Insurance Medicare Agent Huntington Do?

Wiki Article

What Does Paul B Insurance Insurance Agent For Medicare Huntington Do?

Table of ContentsPaul B Insurance Medicare Advantage Plans Huntington Things To Know Before You Get ThisLittle Known Questions About Paul B Insurance Local Medicare Agent Huntington.The Paul B Insurance Medicare Advantage Plans Huntington IdeasOur Paul B Insurance Medicare Supplement Agent Huntington IdeasThe Of Paul B Insurance Medicare Supplement Agent HuntingtonPaul B Insurance Medicare Supplement Agent Huntington Can Be Fun For Anyone

For instance, for some measures, in 2022, if the ranking on that particular step was reduced than the prior year, the ratings returned back to the 2021 worth to hold strategies harmless. An extra 2 percent of enrollees are in plans that were not rated since they are in a plan that is too new or has too reduced registration to receive a score.

The star scores presented in the figure over are what recipients saw when they selected a Medicare prepare for 2023 as well as are different than what is utilized to identify bonus offer repayments. In recent times, Medication, special-interest group has actually increased issues about the star ranking system and also high quality benefit program, including that star rankings are reported at the agreement instead of the plan level, and might not be a beneficial indicator of top quality for recipients due to the fact that they consist of way too many measures.

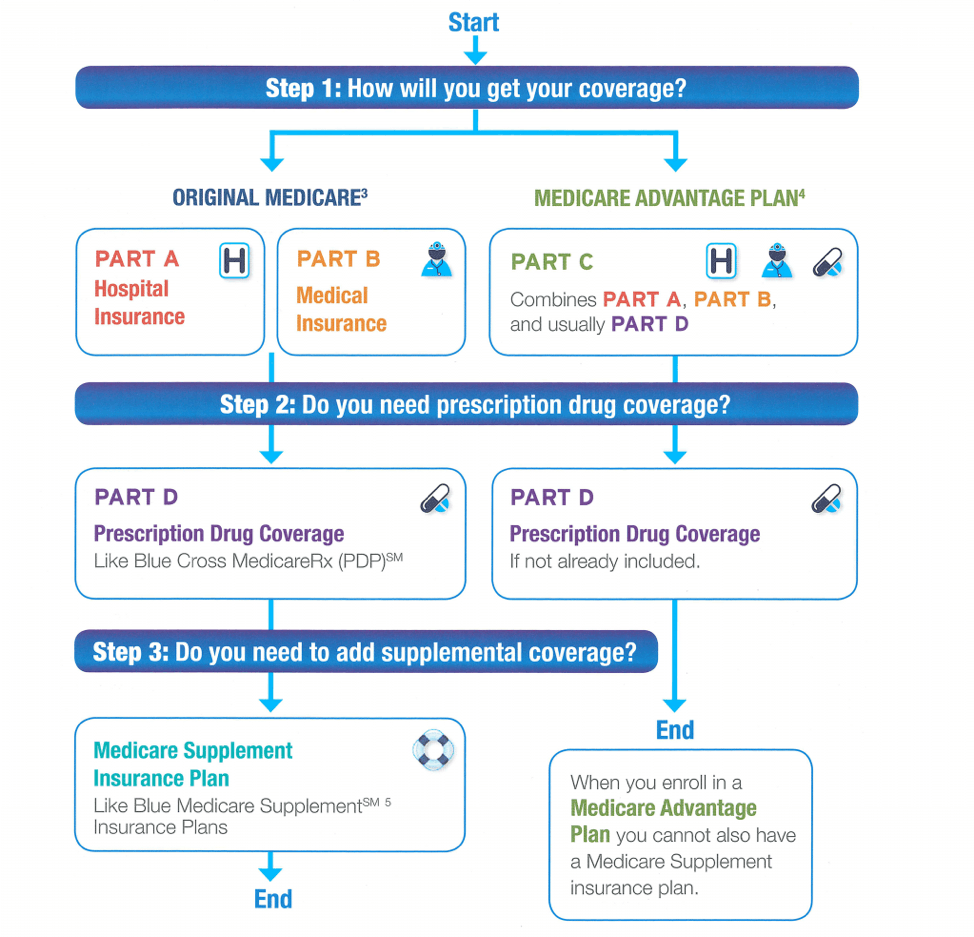

Select a Medicare Supplement strategy (Medigap) to cover copayments, coinsurance, deductibles, as well as various other expenditures not covered by Medicare.

What Does Paul B Insurance Insurance Agent For Medicare Huntington Do?

An HMO might require you to live or operate in its solution area to be qualified for coverage. HMOs usually offer incorporated treatment and focus on avoidance as well as wellness. A sort of strategy where you pay much less if you use physicians, hospitals, and various other health and wellness care companies that belong to the plan's network.A kind of wellness plan where you pay less if you use companies in the strategy's network. You can utilize medical professionals, medical facilities, as well as service providers beyond the network without a referral for an extra cost.

Having a typical resource of care has actually been found to enhance top quality and decrease unneeded care. Most of individuals age 65 and also older reported having a typical provider or area where they obtain care, with slightly higher prices among people in Medicare Advantage plans, people with diabetes mellitus, and also people with high requirements (see Appendix).

Our Paul B Insurance Medicare Insurance Program Huntington Statements

There were not statistically considerable differences in the share of older adults in Medicare Advantage plans reporting that they would certainly constantly or usually obtain a solution about a medical concern the same day they called their typical resource of care compared to those in traditional Medicare (see Appendix). A larger share of older grownups in Medicare Benefit plans had a health treatment specialist they might conveniently call in between doctor brows through for recommendations about their wellness condition (data not revealed).Evaluations by the Medicare Repayment Advisory Commission (Medication, SPECIAL-INTEREST GROUP) have actually revealed that, generally, these plans have reduced clinical loss proportions (suggesting greater profits) than other sorts of Medicare Benefit strategies. This suggests that insurance providers' passion in serving these populaces will likely continue to expand. The searchings for likewise raises the crucial to examine these strategies individually from various other Medicare Advantage prepares in order to make certain top quality, equitable care.

In specific, Medicare Benefit enrollees are more probable than those in conventional Medicare to have a therapy strategy, to have a person that assesses their prescriptions, and to have a see this normal physician or place of care. By supplying this added aid, Medicare Advantage plans are making it less complicated for enrollees to obtain the help they need to handle their health treatment problems.

The smart Trick of Paul B Insurance Medicare Agency Huntington That Nobody is Talking About

The survey results also elevate inquiries regarding whether Medicare Benefit plans are obtaining ideal settlements. Med, political action committee estimates that strategies are paid 4 percent greater than it would set you back to cover similar individuals in typical Medicare. On the one hand, Medicare Benefit prepares seem to be supplying solutions that aid their enrollees handle their care, and also this included treatment administration can be of considerable value to both plan enrollees and the Medicare program.Part B enhances your Part A coverage to offer insurance coverage both in as well as out of the medical facility. Component An as well as Component B were the very first parts of Medicare produced by the federal government. This is why the two parts together are commonly referred to as "Initial Medicare." Furthermore, lots of people who do not have additional coverage via a group strategy (such as those provided by employers) typically register for Components An as well as B at the same time.

The Best Guide To Paul B Insurance Medicare Insurance Program Huntington

The quantity of the why not look here premium varies amongst Medicare Advantage strategies. Medicare Advantage puts a limit on the amount you pay for your covered clinical care in a provided year.And these networks can be a lot more effective in supplying treatment. Therefore, they reduce general healthcare expenses. Some Medicare Advantage plans require you to utilize their network of providers. Others enable you to go to out-of-network service providers, usually for a higher price. As you explore your options, think about whether you wish to continue seeing your present medical professionals when you make the button to Medicare.

Some Known Questions About Paul B Insurance Insurance Agent For Medicare Huntington.

What Medicare Supplement plans cover: Medicare Supplement plans aid handle some out-of-pocket costs that Original Medicare does not cover, including copayments and deductibles. That suggests Medicare Supplement strategies are only available to people that are covered by Initial Medicare. If you choose a Medicare Benefit plan, you're not qualified to get a Medicare Supplement plan.Report this wiki page